Laddered Innovation

Laddered innovation is the process of repeatedly testing the same idea against market conditions in small, discrete periods of time in order to reduce marketing timing risk overall. It uses Innovation Options to compartmentalize and sandbox the downside of any given iteration, while preserving the upside potential of recognizing market shifts earlier than the competition.

I’ve written extensively about Innovation Options, but here’s a quick primer: an option represents the right, but not the obligation, to make future transaction at a set price. They delay investment decisions until more is known about the market.

In this case, every idea represents an Innovation Option with a pre-defined expiration date and (relatively) small set of resources to spend, with a larger growth funding amount available for exercise. During the Option’s life, the spending resources are not used to scale the idea, but are expressly intended for small-scale testing. We want to get market-validated information on that idea’s potential. Then, at Option expiration, we need to make a decision: based on what we’ve learned during testing, do we exercise the option, accept the growth funding, and pursue the idea further (GO)? Or do we let the option expire, reject spending the growth funding, and not pursue the idea (NO-GO)? Thus, the option forces a specific Positive or Negative decision, but with the benefit of actual market testing.

Yet that isn’t the end of it. As with standard statistical testing, our main objective should be to identify and minimize error and focus on what’s true. With an option-based approach, this is fairly straightforward. If the option was exercised, was the idea successful? Did it produce the predicted returns? If so, it’s a Success — True Positive. If not, it was a Failure — False Negative. So far, this looks exactly like traditional assessments, but with the benefit of market testing.

For expired options, it’s a bit more difficult since we must look outside the firm for the answer. However, the basic heuristic is, did some other competitor/entrant produce returns with the same idea? If not, it’s an Opportunity Benefit True Negative — we correctly passed on the idea. Otherwise, it’s an Opportunity Cost False Negative, we considered the idea and missed it. These assessments are, necessarily, subjective. Still, in most cases the results are obvious enough for us to make uncontroversial assessments about the actual results.

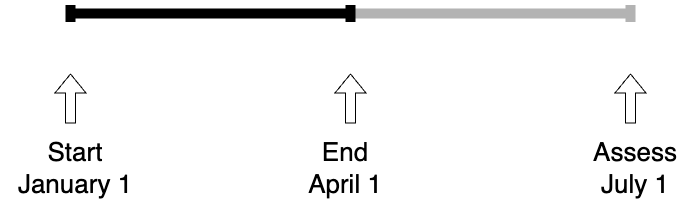

In any case, the assessments themselves should be bounded within a particular observation window. For innovation options, this period should be equal to the duration of the option itself. So, for instance, if the option had a term of three months, then the assessment should be conducted three months after the term expiration.

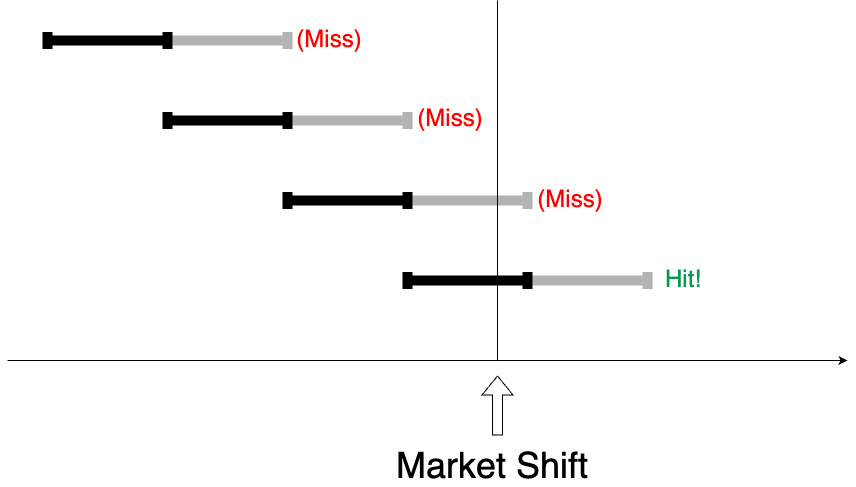

This approach is particularly useful when considered as part of a “laddered portfolio” of options. Here, multiple options are staggered through time, each with a roughly equidistant expiration date. This approach lowers the overall risk in rapidly evolving technology and markets since we remove market timing from the equation. (This approach is analogous to investors who stagger the expiration dates of their bond portfolios for the same reason.)

Consider the following laddered portfolio: if the underlying market makes a significant shift in the latter part of the year, the laddered portfolio will catch it, where the “one and done” will miss.

Such a staggered approach reduces the risk associated with the uncertainty of the time horizon on any given idea. Consider Webvan, one of the most high-profile disasters of the early internet era, which lost nearly a billion dollars pursuing online grocery delivery. In that case, it wasn’t that the idea was fundamentally poor – there are many such delivery companies in operation today – it was that they were simply far too early to operate at the scale they built, and ran out of money before growth materialized. Had they instead pursued a laddered approach, they would have recognized the market inflection point and been well-positioned to scale into it.

As William Gibson famously stated, “the future is already here – it just isn’t evenly distributed”. The laddered innovation portfolio reduces the risk associated with market timing, and allows for the company to be around when that distribution occurs.